Introduction To REIT:

A Real Estate Investment Trust (“REIT”) is a company or trust that owns and manages income-generating real estate. Investors buy shares in the REIT and receive a portion of the rental income from the properties. REITs pool funds from investors to acquire and lease properties, distributing at least 90% of rental income as dividends, and are exempt from income tax on the distributed amount. In India, the Securities and Exchange Board of India (“SEBI”) or (“Board”) introduced real estate mutual funds based on the Association of Mutual Funds in India (“AMFI”) Committee recommendations, followed by draft REIT regulations in 2008. After industry feedback, SEBI finalized and notified the SEBI (Real Estate Investment Trust) Regulations, 2014, in September 2014.

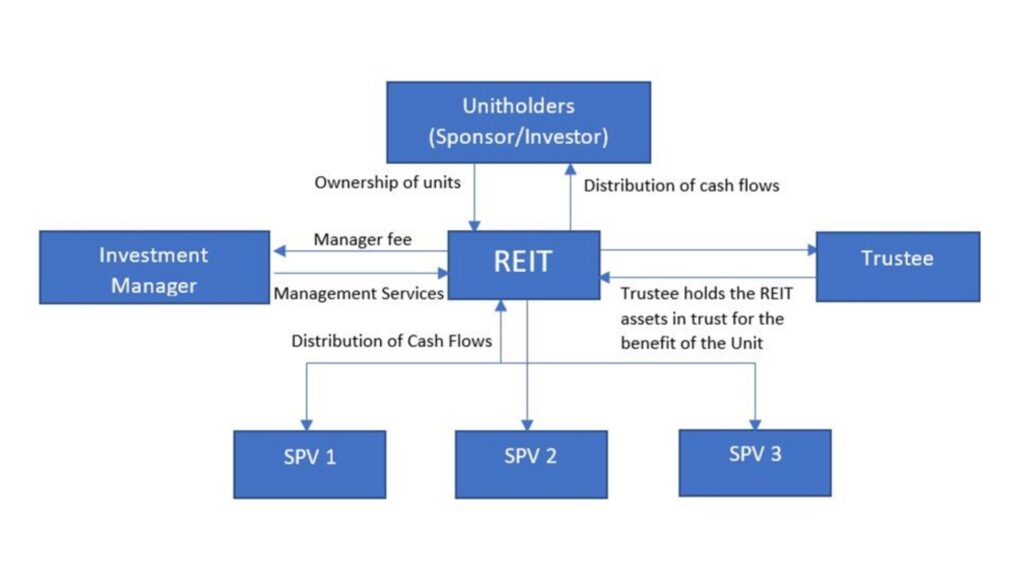

Structure of an REIT:

SM REIT:

In a bid to regulate the fractional ownership industry, SEBI has issued regulations to amend the REIT Regulations 2014, establishing norms for creation of Small and Medium Real Estate Investment Trusts (SM REITs). The move is aimed at regulating and organizing the fractional ownership industry as well as protecting the interests of investors. The amendment regulation has inserted a new chapter, i.e., Chapter VIB that provides the framework for Small and Medium REITS.

The definition of SM REITs, as per the regulatory framework, pertains to real estate investment trusts that pool money from investors under one or more schemes and satisfy the following criteria:

- The size of assets that the SM REIT aims to acquire must fall within the range of at least INR 50 crores and less than INR 500 crores.

- The scheme of the SM REIT must have a minimum of 200 unitholders, excluding the investment manager, its related parties, and associates.

Difference between an REIT and an SM REIT:

| BASIS | REIT | SM REIT |

| Type of Property | Focussed more on commercial real estate. | Residential and commercial real estate. |

| Size | 500 crores and above. | 50 to 500 crores. |

| Investment Route | Directly or through SPV. | Through SPV. |

| Portfolio | 80% of assets in completed projects and maximum 20% in under-construction projects. | Aleast 90% of investment should be in revenue generating assets. Cannot invest in under-construction or non-revenue generating real estate assets. |

| Leverage by REITs | Maximum 49% of the assets. | Maximum 49% of the assets. |

| Distribution of net cash flows | Atleast 90%. | Atleast 95%. |

| Frequency of Distribution | Half yearly. | Quarterly. |

Overview Of SEBI (REIT) Amendment Regulations, 2024[1]:

- Definitions:

- According to regulation 2(1)(zm), “REIT” or “Real Estate Investment Trust” means a person that pools rupees fifty crores or more for the purpose of issuing units to at least two hundred investors so as to acquire and manage real estate asset(s) or property(ies), that would entitle such investors to receive the income generated therefrom without giving them the day-to-day control over the management and operation of such real estate asset(s) or property(ies). The definition of REIT includes an SM REIT.

- According to regulation 26H(c), “Small and Medium REIT” or “SM REIT” means a REIT that pools money from investors under one or more schemes in accordance with sub-regulation (2) of regulation 26P.

- According to regulation 26H(a), “investment manager” means a company incorporated in India, which sets up SM REIT and manages assets and investments of the SM REIT and undertakes operational activities of the SM REIT.

- According to regulation 26H(f), “special purpose vehicle” or “SPV” means any company which is a wholly owned subsidiary of the scheme of the SM REIT and the SPV shall not have any other capital or ownership interest in it.

- Eligibility Criteria for Application as an SM REIT:

Regulation 26j outlines the criteria for granting a registration certificate to an SM REIT, including:

- The applicant must be the investment manager on behalf of the trust, and the trust deed must be duly registered under the Registration Act, 1908;

- The trust deed’s primary objective must be to operate an SM REIT in compliance with these regulations, detailing the trustee’s responsibilities;

- Separate persons must be designated as the investment manager and trustee under these regulations;

- The trustee cannot be an associate of the investment manager;

- No unit holder in the SM REIT scheme should have superior voting or other rights, and there should be no multiple classes of units;

- All unitholders’ rights must be pro-rata and pari-passu;

- The applicant must clearly describe the proposed activities of the SM REIT at the time of registration;

- The SM REIT and its parties must be “fit and proper” according to the criteria in Schedule II of the SEBI (Intermediaries) Regulations, 2008;

- Previous REIT or SM REIT registration applications by the applicant or related parties should not have been rejected by the Board;

- No disciplinary action should have been taken against the SM REIT or its parties, promoters, or directors by the Board or any regulatory authority.

Additionally, as per regulation 26P(2), an SM REIT scheme can only offer units if:

- The asset size in the scheme is between ₹50 crores and ₹500 crores;

- The scheme has at least 200 unitholders, excluding the investment manager, its related parties, and associates.

- Conditions for Grant of Registration for an SM REIT:

The certificate of registration granted to an SM REIT shall be subject to the following conditions:

- the SM REIT shall abide by the provisions of the Act and these regulations;

- the SM REIT shall adhere to the migration plan, if applicable, submitted by it to the Board at the time of application for certificate of registration under this chapter;

- the SM REIT shall forthwith inform the Board in writing, if any information or particulars previously submitted to the Board are found to be false or misleading in any material particular or if there is any material change in the information already submitted;

- the SM REIT and the parties to the SM REIT shall satisfy the conditions specified in this chapter at all times; and

- the SM REIT and the parties to the SM REIT shall comply, at all times, with the Code of Conduct as specified in the Schedule VI, wherever applicable.

If the SM REIT fails to make an initial offer of a scheme within three years from the date of registration with the Board, shall surrender its certificate of registration to the Board and cease to operate as an SM REIT subject to an extension that may be granted by the Board at its discretion for a period up to one year. The SM REIT can subsequently re-apply for registration with the Board under these regulations.

- Conditions for Initial Public Offer (IPO) as per Regulation 26R:

- The investment manager shall appoint one or more merchant bankers registered with the Board for carrying out the obligations pertaining to the public issue.

- The investment manager is required to either identify the real estate assets or properties it intends to acquire or provide detailed features of these assets including their location and other relevant particulars in the draft scheme offer document. This document, along with the specified fees as outlined in Schedule IIA, must be filed with the Board and the designated stock exchange through a merchant banker.

- The minimum price per unit for each scheme of the SM REIT is set at ten lakhs rupees or any other amount specified by the Board. Each scheme must be distinctly named, avoiding any misleading implications of guaranteed returns for investors.

- The value of real estate assets or properties in each scheme should not be less than fifty crore rupees. Both the investment manager and the trustee must ensure the segregation and protection of assets, bank accounts, investment or demat accounts, and books of accounts for each scheme.

- Documentation proving title ownership of real estate assets or properties, along with related paperwork, must be securely stored in safe-deposit boxes at a scheduled commercial bank and annually inspected by the trustee.

- The draft scheme offer document filed with the Board must be publicly accessible for comments on the websites of the Board, designated stock exchanges, and associated merchant bankers for a minimum period of twenty-one days.

- The Board may issue observations within thirty days to the merchant banker based on various timelines, including the receipt of the draft scheme offer document, satisfactory replies, clarifications, or additional information from the merchant banker, or information from other regulators or agencies. The merchant banker is responsible for addressing these observations in the scheme offer document before the scheme’s launch.

- Conditions for Scheme Offer Document as per Regulation 26S:

- The scheme offer document must include all disclosures as outlined in Schedule III, along with any additional disclosures specified by the Board periodically. It is imperative that the scheme offer document of the SM REIT provides accurate, truthful, and comprehensive disclosures to enable investors to make well-informed decisions. These disclosures must be devoid of any misleading information or untrue statements. Under no circumstances should the scheme offer document guarantee returns to investors.

- Furthermore, it should detail the lease rental income for each property intended for acquisition by the SM REIT scheme, alongside comparable lease rental incomes from similar properties. These comparative disclosures must be obtained from or certified by a valuer or other authorized individuals designated by the Board.

- The scheme offer document should explicitly state whether the SM REIT scheme is leveraged or unleveraged, in accordance with the relevant regulations. For schemes without leverage, the investment manager must submit an undertaking at the time of document filing, assuring that no leverage will be utilized in the future. Moreover, the document should disclose the total expense ratio for the SM REIT scheme, adhering to the prescribed format and limits set by the Board.

- Investment Conditions:

According to regulation 26T, the SPV shall directly and solely own all assets that are acquired or proposed to be acquired by the scheme of the SM REIT, of which SPV is the wholly owned subsidiary. The scheme of the SM REIT shall invest at least ninety-five percent of the value of the schemes’ assets for each of its schemes in completed and revenue generating properties and shall not invest in under-construction or non-revenue generating real estate assets: Provided that up to five per cent of the value of the schemes’ assets may be invested in liquid assets, which are unencumbered. The scheme of SM REIT shall not be permitted to lend to any entity other than lending to its own SPV. The SPV shall not be permitted to lend to any entity.

- Modes of Fund Raising:

- The SM REIT scheme attracts both Indian and foreign investors through unit issuance, subject to RBI and Government of India guidelines. Leverage may be used if disclosed in the offer document.

- The scheme raises capital only through unit issuance. If leverage is used, it can involve borrowing.

- SPVs under the SM REIT raise capital through equity investment from the REIT or, if leveraging, through borrowings or debt issuance.

- If leverage is used, borrowings and deferred payments must not exceed 49% of scheme assets’ value, with specific requirements if exceeded, including a credit rating and unit holder approval.

- The issue period cannot exceed 30 days, and units must be issued in dematerialized form.

- The minimum subscription per investor is ₹10 lakhs or as specified by the Board.

- Lock-in Requirements:

- The prescribed minimum unitholding requirement for the investment manager during the initial three-year period, starting from the date of listing of units in the initial offer until the conclusion of the third year from the same listing date, shall be as follows:

- In a SM REIT scheme that has chosen not to engage in leverage, as per disclosures in the scheme offer document submitted for the initial offer, the investment manager must maintain a minimum holding of five percent of the total outstanding units at all times.

- In a SM REIT scheme that has opted for leverage, as per disclosures in the scheme offer document filed for the initial offer, the investment manager must maintain a minimum holding of fifteen percent of the total outstanding units at all times. However, any holding exceeding fifteen percent or five percent, depending on the case, must be retained by the investment manager for a minimum duration of one year from the date of listing of units issued in the initial offer.

Additionally:

- The investment manager must hold at least 5% of the total outstanding units in each SM REIT scheme for two years, starting from the fourth year after the initial listing date and ending at the conclusion of the fifth year.

- The investment manager must hold at least 3% of the total outstanding units for five years, starting from the sixth year after listing and ending at the conclusion of the tenth year.

- The investment manager must hold at least 2% of the total outstanding units for ten years, starting from the eleventh year after listing and ending at the conclusion of the twentieth year.

- After the twentieth year from the initial listing, the investment manager must hold at least 1% of the total outstanding units at all times.

- Units subject to this holding requirement must be unencumbered and locked-in.

- Units issued to investors through the swap of securities allotted before the enforcement date of this regulation will not be counted in the total outstanding units for this purpose.

- Allotment and Listing

- Upon receipt of the application payments, the investment manager shall allocate units to the applicants on behalf of the SM REIT scheme.

- The designated stock exchange’s authorized representatives, in conjunction with post-issue merchant bankers and registrars to the SM REIT scheme, will ensure the fair and proper finalization of the basis of allotment.

- The units of the SM REIT scheme must be listed on recognized stock exchanges with nationwide trading terminals. Allocation and listing timelines for units of a specific SM REIT scheme shall comply with Board specifications. However, failure by the investment manager to adhere to these timelines will result in the payment of interest to investors at a rate of fifteen percent per annum, which cannot be recovered through fees or any other form of payment to the investment manager by the SM REIT.

- Listing of SM REIT scheme units must adhere to the listing agreement between the SM REIT and the designated stock exchange.

- Units of the SM REIT scheme listed on designated stock exchanges will be traded, cleared, and settled according to the byelaws of the relevant stock exchanges and conditions specified by the Board.

- No individual, apart from the investment manager, its related parties, and associates, may hold units of an SM REIT scheme that, combined with units held by them and persons acting in concert, exceed twenty-five percent of the total outstanding units of that SM REIT scheme.

- The merchant banker shall submit post-issue report, along with due diligence certificate, within seven working days of the date of finalization of allotment or within seven working days of refund of money in case of failure of issue, as per the format and in such manner as may be specified by the Board.

- Distributions to unit holders:

With respect to distributions made by the SM REIT scheme and its SPV, the investment manager is obligated to ensure the following:

- At least ninety-five percent of the net distributable cash flows of the SPV are distributed to the SM REIT scheme, subject to relevant provisions in the Companies Act, 2013. Any amount retained by the SPV must be utilized according to the directives specified by the Board.

- One hundred percent of the net distributable cash flows of the SM REIT scheme are to be distributed to the unit holders.

- Distributions must be declared at least once in every quarter of the financial year and not later than fifteen working days from the end of the quarter.

- Distributions must be paid to the unitholders within seven working days of declaration. If the investment manager fails to meet these timelines, they must pay interest at a rate of fifteen percent per annum to the unitholders for the delayed period. Furthermore, any excess interest incurred shall not be recovered by the investment manager from the SM REIT in any form.

In conclusion, the introduction of SM REIT is considered a welcome move by the major players of the industry and creates numerous opportunities for retail and institutional investors to participate in office yielding real estate across various market sizes and product types. According to CREDAI, SEBI’s amendment to the REIT regulations and guidelines for the creation of SM REITs will provide a significant boost to the inflow of investments in the Indian Real Estate Sector.

[1] https://www.sebi.gov.in/legal/regulations/mar-2024/securities-and-exchange-board-of-india-real-estate-investment-trusts-amendment-regulations-2024_82138.html